Data-Driven Trading Insights

SGFX Trading Insights and Learning

Explore the SGFX Blog for expert insights and analysis on futures, indices, stocks, currencies, CFDs, and Forex. Stay informed and ahead in the financial markets with our categorized content.

Categories

Global Markets React to Middle East Tensions as Oil Surges and Stocks Struggle

Oil rallies on geopolitical tensions, global stocks face weekly losses, and currencies react to safe-haven flows as investors reassess risk.

Read more

US–Iran Conflict Triggers Market Turmoil as Oil Surges and Stock Futures Slide

Oil spikes, stock futures tumble and safe havens rally as geopolitical risk surges. Here’s what it means for forex traders, gold investors, and global markets.

Read more

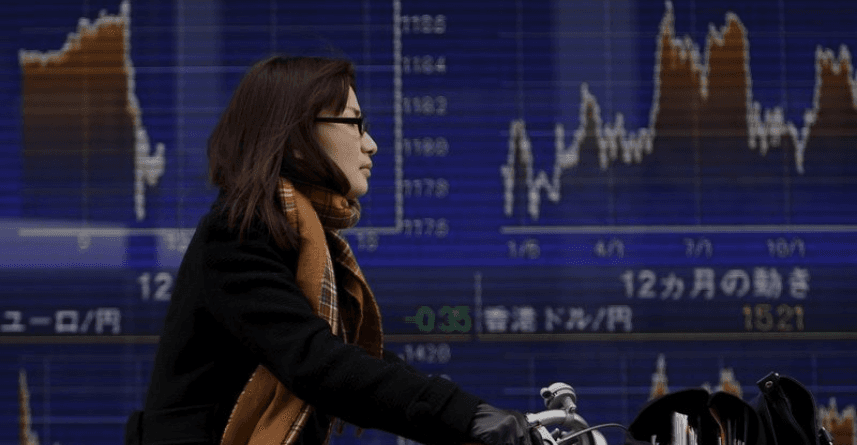

Gold Steady Near $5,200 as Asian Currencies Ease

Asian markets turned cautious into month-end as tech jitters and mixed rate signals pressured stocks and regional FX, while the Aussie outperformed, the yen stayed volatile, China eased FX hedging costs and gold held near $5,200/oz.

Read more

From Biosimilars to AI Chips: What’s Driving Today’s Global Moves

A strong earnings beat in healthcare, rising conviction in the AI chip cycle, and renewed tariff and geopolitical uncertainty are shaping Wednesday’s market direction.

Read more

AI, Tariffs and Pharma Price Cuts Shake Global Markets

A new wave of AI agents is hitting businesses as governments rethink critical minerals pricing frameworks and drugmakers prepare major US list price changes reshaping risk sentiment across sectors.

Read more

From Supreme Court Tariffs to Safe Havens: The New Week’s Trading Map

Stocks react to tariff headlines and tech rotation, while gold gains on weaker US data. Here’s what matters across equities, FX, commodities, and crypto flows.

Read more

Wall Street Softens on Tech Weight; Russia Revenue Hit; Bitcoin ETF Demand Remains a Pillar

Wall Street slips under tech pressure, private equity jitters resurface, Russia’s energy income takes a hit, and Bitcoin ETF flows remain net positive setting up a headline-heavy session for multi-asset traders.

Read more

Berkshire reveals a new NYT position and trims Big Tech

Berkshire Hathaway’s latest 13F widely seen as the “last of the Buffett era” showed a new stake in The New York Times and trims in mega-cap tech. Here’s what it may signal for sentiment, sector rotation, and trade setups.

Read more

UK Labour Cooling Hits GBP While Holiday Liquidity Distorts Price Action

Sterling weakened after UK labour data, global shares edged higher in thin trading, and earnings delivered mixed market reactions setting up a tactical week for forex trading, indices trading, and CFD trading on SGFX.

Read more

Markets Enter “Sniper’s Alley”

AI disruption fears, shifting rate expectations and crypto volatility are pushing markets into a high-risk, high-opportunity phase. Here’s what traders should watch this week and how to stay tactical across FX, commodities, and indices.

Read more

Alibaba Drops as Geopolitical Risk Returns to China Tech

Alibaba fell sharply on reports it could be added to a Pentagon-linked list, raising geopolitical risk concerns and lifting volatility across China tech.

Read more

Wall Street Focus Shifts From Earnings Beats to 2026 Outlook

Markets digest a flood of earnings reports, biotech breakthroughs, semiconductor momentum, and shifting rate expectations as investors focus on forward guidance over headline beats.

Read more

From ADP to Bitcoin: What’s Moving Markets!

Today’s tape is being driven by deal chatter, clinical trial wins, and a fresh read on U.S. jobs momentum, with Bitcoin, gold, and high-beta stocks reacting fast. Here’s how to trade the moves efficiently on MT5 with cleaner execution and smarter risk control.

Read more

The Technology Behind Faster Execution, Smarter Analysis, and Better Trades

From market analysis to execution and risk management, see what defines a high-performance trading platform built for today’s fast-moving markets.

Read more

A New Risk Regime Is Emerging Across Tech Commodities and Global Growth

A higher Mexico growth forecast, a record-scale SpaceX–xAI tie-up, fresh EV safety rules in China, and a Gulf PMI check-in are reshaping expectations across FX, equities, and commodities. Here’s the clean trader view, built for execution on MT5.

Read more

From Tech Funding to Metal Swings Volatility Is Reshaping Global Trading

Markets opened the week with sharp moves across tech, metals, and energy as funding plans, consolidation, and volatility reshaped trader sentiment. Here’s what active traders should know and how to stay positioned using the MT5 trading platform.

Read more

Dollar Moves, AI Optimism and Record Metals: The Key Trading Themes This Week

Global markets are being reshaped by AI breakthroughs, central bank decisions and record-breaking commodity moves. Here’s how traders can navigate today’s volatility using MT5 trading platforms, smart risk tools and multi-asset strategies.

Read more

Risk Appetite Surges as Gold Shines

Global markets are sending mixed signals as risk appetite rises, stocks swing, and gold attracts safe-haven demand. Discover how traders can navigate volatility using MT5.

Read more

Strong U.S. Manufacturing Pulse Meets Fed Week Volatility

U.S. Durable Goods Orders jumped 5.3% vs 3.1% forecast, giving markets a fresh growth signal just as traders prepare for a key Fed decision and major tech earnings. Here’s how to approach the week using MetaTrader 5 (MT5) with a clear, non-boring plan.

Read more

Equities Push Higher as Sentiment Improves

Global markets move higher as geopolitical concerns soften and traders turn their focus to earnings and U.S. economic data. Here’s how MT5 traders can navigate the current setup with discipline and precision.

Read more

Tariffs, Tension and Tight Risk

Markets can pivot in minutes tariff headlines, record metals and shifting energy margins are all moving prices. Here’s how traders use a modern multi-asset setup to stay ready, manage risk and execute quickly across forex, commodities, indices and stocks.

Read more

Greenland Tariff Shock Meets Energy Earnings Slump

Gold hits new record highs as tariff tensions reignite volatility. Explore how traders use MetaTrader 5 tools to navigate gold trading, silver trading, forex volatility and risk management with confidence.

Read more

A New Playbook for 2026: Trading the AI Infrastructure Shift

AI demand hasn’t cooled, but the market narrative is shifting from “who sells GPUs” to “who fixes the memory bottleneck.” Here’s a news-led, MT5-ready framework to trade semis in 2026 with cleaner execution and less noise-chasing.

Read more

From TSMC Capex to U.S. Chip Tariffs

AI demand is still powering the semiconductor cycle, but fresh U.S. tariff moves and geopolitics are changing how markets price risk. Here’s a practical MT5-focused trading framework for 2026 - built for speed, discipline, and cleaner execution.

Read more

Safe-Haven Rush in 2026: Trading Gold, Silver and FX with MT5 Tools

Gold and silver are making new highs, oil is reacting to supply-risk headlines, and volatility is picking up. Here’s a practical, trader-focused guide on how to approach the market using MT5, with risk control and clean execution in mind.

Read more

Markets Reprice Risk Ahead of CPI as Energy Jumps

Oil rises for a fourth straight session as supply disruption risks stay in focus, while the dollar firms ahead of CPI. Learn how traders use MT5 / MetaTrader 5 for forex trading, oil trading and indices trading with fast execution and structured risk controls.

Read more

From Dollar Weakness to Gold Strength: Understanding Market Shifts

Gold surges to record highs as political and geopolitical risks reshape markets. Discover how traders use MT5 trading platforms to trade gold, forex and indices with speed and control.

Read more

Market Uncertainty Rises - Here’s How MT5 Traders Stay Ahead

Explore how global market volatility, economic data, and geopolitical shifts are influencing trading opportunities and why traders are choosing MT5 trading platforms to stay ahead.

Read more

Cross-Asset Trading in 2026: Opportunities on MT5 with SGFX

Global markets are navigating shifting themes in early 2026 as traders balance geopolitics, sector rotations and macro data. Discover how modern traders are positioning across forex, crypto, stocks and gold using the MT5 trading platform.

Read more

Global Markets in 2026: How Traders Are Navigating Volatility on MT5

AI innovation, renewed safe-haven demand and global market rotation are shaping trading opportunities in 2026. Discover how traders are navigating crypto, gold, forex and indices using MT5 multi-asset trading on SGFX.

Read more

Crypto, Gold, Forex & Stocks: A Trader’s Guide to MT5 in 2026

Markets are moving fast in 2026. From Bitcoin momentum to gold’s safe-haven rally and AI-led equities, discover how traders are navigating volatility using MT5 multi-asset trading on SGFX.

Read more

Markets Open 2026 Strong: Key Trading Opportunities on MT5

Global markets, including forex, indices, commodities, and cryptocurrency, open 2026 with renewed momentum. Discover how traders can approach the new year strategically using MetaTrader 5 (MT5), advanced trading tools and multi-asset trading access.

Read more

Trading the Crosswinds: How Crypto Swings, FX Signals and Commodities Are Driving Markets

Bitcoin cools, gold steadies, and Asia FX holds firm as year-end markets reward precision, speed and multi-asset trading access.

Read more

Year-End Markets in Motion: Asia, AI Chips, Crypto and Commodities in Focus

Crypto volatility, Asia FX consolidation, and gold stabilization,how traders can navigate thin markets with the right MT5 trading platform.

Read more

From Asia to Crypto: How Active Traders Are Positioning for the Next Move

Asian equities, commodities, and digital assets are driving selective opportunities as liquidity thins and volatility spikes. Traders are shifting focus toward execution quality, market access and platform performance.

Read more

Shifting Rates, Surging Metals and Tech Momentum: A New Phase for Active Traders

AI stocks, Asia FX, record-high gold and shifting rate expectations are redefining trading strategies. Here’s how traders are navigating today’s fast-moving global markets.

Read more

Markets in Motion: How Traders Can Navigate Gold Records, Asia FX Shifts and Crypto Volatility with the Right MT5 Platform

Gold prices hit record highs, Asia FX reacts to intervention risks, and crypto markets stay volatile. Discover how traders can stay agile using a professional MT5 trading platform built for fast execution and multi-asset opportunities.

Read more

From Gold to Crypto: Why Serious Traders Are Upgrading Their Trading Platforms

Global markets are shifting fast from gold hitting record highs to FX volatility across Asia. Discover how choosing the right MT5 trading platform can give traders an edge in execution, pricing and multi-asset access during uncertain times.

Read more

Gold at Record Highs, FX in Focus: How Traders Can Navigate Today’s Markets

Global markets are responding to inflation data, central-bank signals and record-high gold prices. Discover how traders can identify opportunities across forex, gold, commodities, indices and MT5 trading platforms.

Read more

From AI Breakouts to Central Bank Signals: Key Market Trends Every MT5 Trader Is Watching

Markets are navigating renewed AI optimism, shifting central-bank policies, and rising geopolitical risks creating fresh trading opportunities across forex, commodities, indices, and crypto.

Read more

Why Smart Traders Are Adapting Fast in Today’s High-Volatility Markets

AI-driven stocks, central bank decisions and global volatility are reshaping trading opportunities. Discover how traders can stay ahead using the right trading platform.

Read more

Volatility Returns as AI Momentum Meets Central Bank Reality

Global markets are navigating a complex phase driven by AI-led volatility, shifting central-bank expectations, and renewed focus on macro data. From tech stocks to currencies and commodities, traders face fast-moving opportunities that demand agility and informed decision-making.

Read more

Tech Turbulence and Central Bank Signals Set the Market’s Next Move

Global markets are navigating a delicate balance as AI-driven optimism clashes with central bank caution and mixed economic data from Asia.

Read more

Markets Navigate AI Volatility and Central Bank Signals as Asia Sets the Tone

AI volatility, central bank signals, and key economic data are reshaping global markets as Asia sets the tone for cautious trading.

Read more

Asia Sets the Market Mood Amid AI Uncertainty and Shifting Central Bank Expectations

AI volatility, central bank signals, and China’s slowdown are reshaping global market momentum. Here’s what traders need to watch across FX, equities, and commodities.

Read more

Central Banks, AI Growth and Corporate Actions Set the Tone for Markets

Tech swings, FX shifts, and corporate moves reshape global markets, here’s what SGFX traders need to know today.

Read more

Markets React to Fresh AI Investments, Fed Caution and Accelerating Tech Competition

AI megadeals, China’s deflation worries, chipmaker volatility and oil steadies ahead of key Fed signals.

Read more

In Focus as AI Investments, Tech Moves and Fed Signals Shape Sentiment

AI investments surge, central banks stay cautious and global stocks react sharply as markets balance growth optimism with macro uncertainty.

Read more

Investor sentiment remains steady as tech, energy and policy shifts influence market direction.

Markets steady as tech leads, Fed uncertainty lingers and global earnings drive major stock moves.

Read more

Corporate headlines fuel strong single-stock moves across markets.

Corporate deals, earnings wins and market-moving rumors pushed global stocks higher as investors brace for key inflation data and the final stretch of the trading year.

Read more

Tech Momentum, Rate-Cut Bets and High-Impact Corporate Moves Shape Investor Sentiment

Bitcoin slips, Asian markets hesitate and tech stocks drive volatility as investors position ahead of key U.S. inflation data and central bank decisions.

Read more

Auto Leadership, Crypto Volatility and Shifting Rate Expectations Shape Trading Sentiment

European auto picks gain attention, crypto turns red ahead of U.S. inflation data and Asia reacts to RBI rate cuts. Here’s everything moving markets today.

Read more

A Balanced Start With Pockets of Strong Momentum

Equities steady, crypto rebounds, commodities move on geopolitical shifts, here’s what is shaping today’s markets and what traders should watch next.

Read more

A Day of Split Sentiment Across Regions

Markets hold steady as Asia splits, oil steadies, and crypto rebounds while traders look ahead to U.S. data and Fed policy clues.

Read more

Markets React to U.S. Political Shifts, Asian Economic Signals and Renewed Tech Momentum

Political headlines, BOJ signals and shifting rate-cut expectations shape today’s global market mood.

Read more

Asian currencies strengthen, gold cools and tech rebounds as global markets navigate mixed signals full SGFX market breakdown inside.

Asian currencies strengthen, gold cools and tech rebounds as global markets navigate mixed signals full SGFX market breakdown inside.

Read more

Tech Rebounds, Rate-Cut Bets Build and Asia Leads Broad-Based Rally

Global markets rise as tech rebounds, rate-cut expectations grow and Asia leads a broad risk-on shift today’s full SGFX market breakdown inside.

Read more

Tech Stocks Lead a Broad Recovery

Markets rebound as tech leads a global rally, gold climbs on rate-cut optimism, and currencies steady ahead of key U.S. data today’s full market rundown inside.

Read more

Rate-Cut Hopes Resurface, but Tech and Geopolitics Keep Traders on Alert

Markets rebound on renewed rate-cut hopes as tech stabilizes and global sentiment improves, here’s what traders need to know today.

Read more

Markets Slip as AI Valuation Fears Intensify While Japan Approves Major Spending Package

AI stocks slump, Japan unveils major stimulus, oil eases, and markets brace for key economic data.

Read more

AI Confidence Returns, Tech Stocks Rebound and Global Markets Stabilize Ahead of Key Data

AI optimism lifts global markets; tech stocks rally, China stimulus boosts sentiment and traders await key U.S. data for the next market move.

Read more

Bitcoin Recovers, Gold Strengthens and Tech Shares Face Renewed Pressure

Bitcoin recovers, gold gains and tech stocks wobble as traders brace for key data and earnings.

Read more

Markets Slip as Investors Brace for Key Data and Fresh Tech Uncertainty

Tech weakness, rate-cut uncertainty and geopolitical tensions shape today’s trading mood.

Read more

Allianz and Swiss Re Boost Confidence as Tech and Crypto Falter

Allianz and Swiss Re lifted investor confidence with record profits, while Asia faced mixed data and crypto losses. Traders remain cautious amid slower growth and geopolitical tension.

Read more

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Insurance leads Europe’s rally while tech and crypto face correction. Gold remains resilient amid renewed economic uncertainty and mixed rate expectations.

Read more

Markets Steady as U.S. Reopens: Gold Surges, AI Stocks Dominate and Oil Slips on Supply Jitters

Markets steadied after the U.S. government reopened. Gold surged, AI-linked stocks advanced, and oil prices softened as investors adjusted to the new macro landscape.

Read more

Markets Eye U.S. Reopening and Rate Path as Gold Cools, Tech Rotates and Crypto Steadies

Gold slipped from three-week highs as the dollar stabilized, while Bitcoin held near $104K and Asia’s tech sector showed resilience amid mixed global cues.

Read more

Markets Lift as Shutdown Nears End: Gold Shines, Bitcoin Steadies and Asia Recovers

Gold hit a three-week high, crypto prices stabilized, and Asia’s tech rebound extended gains as global risk sentiment improved ahead of U.S. policy progress.

Read more

Global Markets Rebound as Bitcoin, Gold, and Tech Stocks Surge Amid U.S. Shutdown Progress

Bitcoin soared past $106K, gold hit $4,000/oz, and Asian stocks rebounded as easing U.S. political tensions revived global risk appetite.

Read more

Shein Forecasts $2 Billion Profit for 2025 Despite U.S. Tariffs

The Chinese fast-fashion giant Shein projects a $2 billion profit in 2025, defying headwinds from U.S. tariffs and a tougher global retail climate.

Read more

Global Markets Steady as Corporate Earnings and AI Momentum Drive Investor Focus

Markets stabilize amid mixed corporate results and renewed AI momentum. From Adecco’s strong Q3 to Microsoft’s UAE expansion and Bitcoin’s fragile recovery, SGFX breaks down the global forces shaping investor sentiment this week.

Read more

Global Markets Pulse: Corporate Earnings, AI Expansion, and Crypto Turbulence Define the Week

Global markets saw a mix of optimism and volatility as strong earnings clashed with crypto corrections and AI expansion. From Microsoft’s UAE data center to Bitcoin’s drop below $100K, SGFX explores what these shifts mean for traders eyeing opportunities in Q4.

Read more

Global Markets React as Nintendo, Starbucks, and Bitcoin Drive Headlines

Nintendo’s Switch 2 powers record sales, Starbucks reshapes its China strategy, and Bitcoin plunges after a massive liquidation wave. SGFX breaks down how these moves signal diverging trends in global consumer demand, tech innovation, and digital market sentiment.

Read more

Bitcoin’s ‘Coinbase Premium’ Turns Negative After October Losses

Bitcoin’s momentum fades as October ends in red and the Coinbase Premium flips negative, hinting at waning U.S. demand and a more cautious trading environment. SGFX examines what this shift means for global crypto sentiment and short-term price direction.

Read more

Hyundai and Nvidia Join Forces on $3 Billion South Korean AI Cluster Initiative

South Korea’s $3 billion AI initiative marks a defining shift in global technology and industry. With Hyundai and Nvidia leading the charge, the project cements AI’s role in driving industrial transformation, data-driven automation, and long-term investment opportunities across key sectors.

Read more

Global Markets Inch Higher as Tech, Trade and Banks Take Centre Stage

Markets steady as banking resilience, tech updates, and trade optimism drive sentiment. SGFX highlights how selective positioning amid earnings beats and policy shifts can uncover new opportunities for traders.

Read more

Markets Digest: Banking Confidence, Tech Deals & Trade Optimism

Standard Chartered sees no portfolio stress, BNP Paribas posts trading gains, Skyworks eyes Qorvo and Bitcoin dips as trade optimism firm. SGFX highlights tactical opportunities amid evolving sentiment.

Read more

Global Markets Surge on Trade Optimism and Rate-Cut Hopes

Hyundai’s U.S. nuclear deal, Microsoft’s AI momentum, and Bitcoin’s rebound to $115k shaped a bullish trading day. SGFX sees tactical opportunities emerging as rate-cut hopes and trade progress reignite market risk appetite.

Read more

Corporate Earnings Diverge: Structural Winners vs. Legacy Drags

Global earnings updates highlight a shifting investment landscape, one where sustainability, innovation, and operational agility define winners. As inflation data and sector realignments shape investor sentiment, the SGFX insight points toward selective positioning for resilience in a volatile macro environment.

Read more

Unilever Delivers Steady Q3 Growth with 3.9% Sales Rise, Keeps 2025 Outlook on Track

Strong growth in Beauty & Wellbeing and Personal Care offset regional slowdowns, while North America led gains. With the ice-cream division’s demerger approaching and premium brands driving margins, Unilever is showing steady progress toward its transformation goals.

Read more

Heineken, Reckitt & UniCredit Highlight Uneven Global Growth Trends

Corporate results reveal mixed growth signals; traders eye gold, banks, and inflation data for direction.

Read more

Gold Nears $4,400 as Safe-Haven Demand Rises; TSMC, Oracle and Micron in Focus

Gold surges toward $4,400, TSMC and Oracle drive tech resilience, and global markets balance optimism with caution.

Read more

Gold Glitters as TSMC and Oracle Lift Market Sentiment Amid Fed Cut Hopes

Gold rallies, TSMC shines, and Oracle expands its AI edge, markets hold steady as investors bet on a Fed rate cut.

Read more

Gold Nears $4,200 as Markets Ride Earnings Optimism and Fed Easing Hopes

Gold surges, tech rallies, and oil steadies, global markets eye Fed rate cuts and Q3 earnings with renewed optimism.

Read more

AI, Trade and Energy Shape Global Markets as Gold Holds Steady

AI spending climbs, trade tensions return, and gold steadies near $4,000, markets pivot between innovation and caution.

Read more

Gold Glitters at New Highs as U.S.–China Tensions Spark Market Turbulence

Gold hits a record high near $4,100, tech stocks stumble, and markets brace for renewed U.S.–China trade friction.

Read more

Global Markets Steady as AI, M&A and Policy Moves Dominate Headlines

SoftBank’s Arm-backed loan, China’s chip crackdown and AI-driven deals shape a week of global realignments, where innovation meets uncertainty.

Read more

China’s Clampdown, AI Expansion and Commodity Calm Shape Global Sentiment

China tightens its grip on rare earths, AI giants expand globally, and gold steadies above $4,000, a week where markets balance power plays with progress.

Read more

Energy, Tech & Global Shifts Shape Investor Sentiment

Oil, EVs, AI, and crypto, this week’s market movers tell a story of both risk and opportunity. From JPMorgan’s energy picks to Tesla’s EV challenges, and from gold’s resilience to Bitcoin’s surge, here’s what traders need to know heading into Q4.

Read more

Markets Juggle Shutdown Fears, Gold Records and Tech Surges

Shutdown jitters, gold’s record run, and EV-chip rallies are shaping global markets. Here’s what traders should watch this week.

Read more

Markets Face Gold Highs, Shutdown Uncertainty and Bold Corporate Moves

Adani shines, Chinese chipmakers rally, and Intel rockets on Nvidia’s $5B stake. Meanwhile, the Bank of Japan’s ETF unwind shakes Tokyo markets. Here’s what traders need to know.

Read more

Markets Balance Gold Highs, Shutdown Risks and Big Corporate Moves

Markets juggle record gold, shutdown fears, and $8B pharma deals, while Bitcoin surges past $114k. Here’s what traders are watching now.

Read more

Markets Juggle Tariffs, Gold Surge and Pharma Shake-Ups Amid Shutdown Risks

Gold at $3,800, pharma under tariff pressure, and Genmab’s $8B Merus buyout headline a busy trading week. Learn how FX, oil, and equities are shaping the next market moves.

Read more

Markets on Alert: Tariffs, Oil Swings and Inflation Signals Ahead

Tariffs hit pharma, Intel rallies, oil cools, global markets brace for U.S. PCE inflation data. Discover what traders should watch next with SGFX insights.

Read more

From Accenture to Apple: What’s Moving Markets This Week

Accenture earnings, Apple vs EU, Chery’s $1.2B IPO, oil eases, gold steady; here’s what traders need to know.

Read more

AI Bets, Gold Strength and Policy Shocks

AI optimism lifts Alibaba, gold holds firm, oil gains, and currencies steady; here’s what traders are watching now.

Read more

The Week Volatility Took Center Stage

Gold glitters, tech rallies, IT faces policy shock, and pharma stumbles; here’s what traders are watching now.

Read more

Gold Nears Record, Intel–Nvidia Buzz and Shifting Global Flows

Gold nears records, Indian IT slides, oil steadies, and chip stocks stay volatile, here’s what traders need to know.

Read more

Global Equities Surge, Adani Leads, BOJ Steadies, Intel & Nvidia Steal Spotlight

Adani shines, Chinese chipmakers rally, and Intel rockets on Nvidia’s $5B stake. Meanwhile, the Bank of Japan’s ETF unwind shakes Tokyo markets. Here’s what traders need to know.

Read more

Bitcoin Steadies at $117K as Fed Rate Cut and SEC Shake-Up Reshape Markets

Crypto steadies, stocks react: Bitcoin at $117K amid Fed and SEC moves.

Read more

AI Buzz, IPO Surges and Commodity Watch

Markets weigh Fed signals as IPOs soar, tech rallies and commodities hold steady.

Read more

From Gold to Oil: Why Markets Are Holding Their Breath

Gold steady, EVs surge, currencies muted, all eyes on the Fed.

Read more

Gold Steady, EVs Surge and Fed in Focus

Gold steady, EVs surge, currencies muted, all eyes on the Fed.

Read more

AI Shifts, IPO Buzz and Commodity Moves

Markets rally on AI breakthroughs, strong IPOs, and shifting commodity trends, with Asia leading the charge.

Read more

Markets Today: Mergers, Tech Turbulence and Oil Steadying

Markets react to deal activity, AI optimism, and energy shifts while currencies hold cautious ahead of U.S. inflation data.

Read more

Apple’s Supplier Jitters, Asia Forex Moves & Energy Shifts

Traders face a week of mixed signals, with tech jitters, Forex sensitivity, and oil volatility shaping opportunities across global markets.

Read more

M&A Deals, AI Bets, and Market Highs

ASML bets big on AI, Novartis strikes a biotech deal, and gold hits record highs as markets eye Fed cuts.

Read more

AI Push, Corporate Shifts, and Policy Moves Shape Investor Sentiment

From Alibaba’s AI breakthrough to OPEC+ production moves, catch this week’s key market trends and opportunities.

Read more

Global Markets React to Earnings, Ratings, and Policy Shifts

Earnings and ratings lift select stocks, but commodities and currencies highlight ongoing uncertainty.

Read more

Earnings, Policy Moves, and Commodity Swings

Strong earnings offer hope, but economic risks and policy shifts keep global markets on edge.

Read more

Global Markets Balance Strong Earnings Against Rising Economic Uncertainty

Earnings optimism meets economic and policy uncertainty, leaving markets caught between growth hopes and risk concerns.

Read more

Global Equities Mixed, FX Pressured & Commodities in Focus

Earnings strength lifted confidence, while currency moves and commodity swings highlighted the fragile balance driving global markets.

Read more

Earnings Surprises, Asia Struggles & Commodities in Focus

Strong earnings boost confidence, while Asia struggles and oil retreats.

Read more

Volatility Returns as Traders Weigh Earnings, Fed Policy, and Oil Prices

From earnings beats to currency moves; here’s what’s shaping today’s market outlook.

Read more

Global Markets Update: Manufacturing Weakness, Nvidia Risks, and Tesla’s European Decline

Markets stay cautious as Asia’s slowdown, Tesla’s 40% Europe sales drop, and Nvidia’s weak outlook weigh on sentiment, with focus shifting to upcoming U.S. data.

Read more

Market Pulse: CEO Moves, Tariff Tensions, and Tech Buzz Shape Trading Outlook

Global markets shift as Givaudan announces a new CEO, Nvidia earnings drive tech gains, and U.S.-India tariffs impact forex and commodities. Trade the latest moves with SGFX.

Read more

Markets Brace for Powell Speech as Analyst Ratings, M&A Moves and Global Politics Shape Sentiment

Global stocks steady ahead of Powell speech; analyst ratings, M&A deals, and geopolitical shifts drive sector moves.

Read more

SGFX Market Brief: Robotics Breakthroughs, Corporate Shake-Ups, and Fed in Focus

Investors eye Fed signals at Jackson Hole as corporate updates from tech, retail, and insurance shape market momentum.

Read more

Powell Faces Pressure at Jackson Hole as Trump Weighs Legal Action

All eyes are on Powell’s Jackson Hole speech as the Fed weighs inflation risks, job market weakness, and Trump’s mounting pressure.

Read more

Trump-Putin Alaska Summit Ends Without Breakthrough on Ukraine

Trump and Putin’s Alaska summit ended with no breakthrough on Ukraine, leaving future talks uncertain.

Read more

Global Markets Mixed as Corporate Moves Dominate Headlines

Markets shift with tech highs, Mondi downgrade, and crypto gains as Fed and global events loom.

Read more

Markets Rally on Easing U.S. Inflation, Key Corporate Moves Drive Stock Surges

Markets rose as U.S. inflation matched forecasts, fueling rate-cut optimism and lifting key stocks across tech, energy, and resources.

Read more

Global Market Insights: From Ultra-Fast Fashion to Gold’s Bullish Run and Currency Moves

Key market moves on fashion regulation, currency shifts, commodity prices, gold trends, and savings rates

Read more

Market Movers Today: SoftBank’s Big Play, Analyst Upgrades & Global Shakeups

SoftBank's bold AI bet, analyst upgrades, earnings surprises, and global macro shifts are reshaping today’s market outlook.

Read more

Japanese Investors Withdraw from Foreign Stocks Amid U.S. Economic Woes and Tariff Tensions

Japanese investors sold $5B in foreign stocks amid U.S. economic worries and tariff tensions.

Read more

Tesla Faces Shareholder Lawsuit Over Troubled Robotaxi Rollout

Tesla faces shareholder lawsuit over Robotaxi safety claims after failed test and stock value drop..

Read more

Indian Rupee Hits Record Low Amid Trump’s Tariff Threat

Rupee hits record low after Trump tariff threat; RBI rate cut expected amid economic pressure.

Read more

Global Markets Today: Asia Mixed, Gold Shines, Bitcoin Steady Amid Tariff & Jobs Uncertainty

Asia Stocks Mixed, Gold Steady, Bitcoin Holds $114K

Read more

Figma Up by 250% on IPO Debut, Valuation Soars Past $60 Billion

Figma stock up by 250% in its IPO debut, hitting a $65B valuation. Learn what fueled the rally and what it means for tech IPOs and investors.

Read more

Global Market Update- July 31, 2025

BOJ holds rates, China data drags markets, oil steady. Strong earnings from banks, Renault slumps. Samsung gains on tariff deal news.

Read more

What Is Indices Trading and What Are the Best Strategies for Trading Indices?

Indices trading represents a dynamic aspect of the financial markets, offering both diversification and strategic gains.

Read more

Mastering Forex Trading in UAE: A Step-by-Step Guide

Foreign exchange or Forex trading has become popular in the UAE in the last couple of years because many investors look forward to gaining access to the global currency markets. Be it at the starting phase of trading or while polishing the skills, one should be aware of the basic facts about Forex Trading in UAE to be a success in it. This eBook shall cover the basics of Forex trading, significant factors that influence markets, and effective strategies to be deployed with confident trades in Spectra Global.

Read more

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.