Tue, Sep 23

2 min

The Week Volatility Took Center Stage

Summary

Gold hovers near record highs as Fed optimism lifts safe-haven demand, Indian IT faces U.S. visa fee headwinds, tech momentum intensifies with Apple and Nvidia gains, while pharma and luxury stocks struggle under policy and rating pressures.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Markets delivered a mixed bag this week, balancing Fed-driven optimism with fresh policy shocks. Gold’s climb toward record levels underscored investor caution, even as tech stocks fueled momentum on blockbuster AI and hardware headlines. Indian IT firms felt the strain of potential U.S. visa fee hikes, while pharma and luxury names battled regulatory and demand concerns. For traders, volatility is opening both risks and opportunities across asset classes.

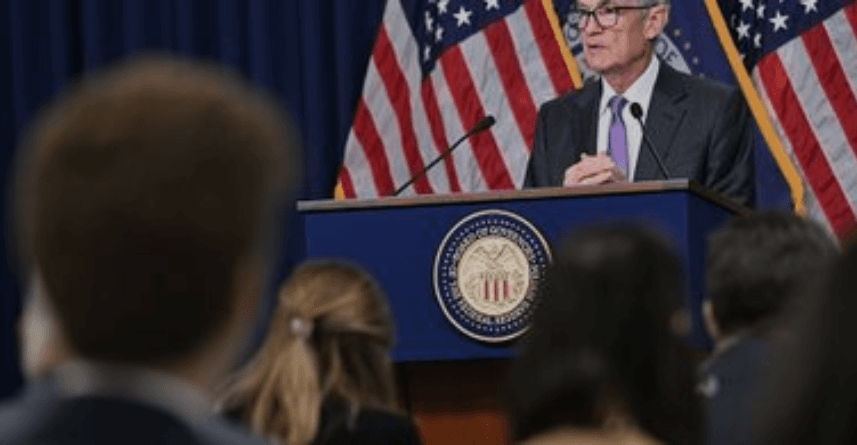

Gold Pushes Higher on Fed Optimism

Gold prices continued their upward march, with spot gold and futures holding near record highs after the Federal Reserve’s latest rate cut. Traders welcomed the move as a boost for liquidity, while ongoing uncertainty kept demand for safe-haven assets elevated. With policymakers signaling a dovish stance, bullion remains well positioned as investors look for protection against potential volatility ahead.

Indian IT Faces Policy Risks

The Indian IT sector once again found itself under pressure as reports suggested the Trump administration could introduce a $100,000 fee for H-1B visa applications. While select names like Infosys and Accenture managed to post modest gains, the broader sector index slipped. This highlights how sensitive India’s export-driven technology sector remains to U.S. policy decisions, particularly around labor mobility and operating costs.

Tech Momentum Driven by Apple and Nvidia

Technology stocks continued to dominate headlines, with Apple surging on reports that supplier Luxshare may be working on a hardware deal with OpenAI. Nvidia extended its rally to fresh all-time highs after announcing a $100 billion strategic partnership with the AI pioneer, underscoring its leadership in the chip sector. Oracle also saw strong gains as investors speculated on expanded cloud collaboration, cementing tech as the engine of market momentum.

Pharma and Luxury Struggle

In contrast, pharma and consumer stocks faced headwinds. Asian drugmakers fell sharply after Trump raised fresh concerns about the safety of acetaminophen, triggering a heavy selloff in Kenvue and related manufacturers. Meanwhile, Jefferies struck a cautious note on luxury, reiterating its underperform rating on Burberry, arguing that hopes of a quick recovery in the brand’s performance remain overstated.

SGFX Summary

The global markets are entering a dynamic phase where multiple forces are shaping sentiment. Adani’s regulatory relief has reignited investor confidence in Indian equities, paving the way for potential fresh inflows. Meanwhile, Chinese semiconductor stocks continue to rally as the U.S.–China technology rivalry intensifies, keeping the chip sector highly volatile. In Japan, the Bank of Japan’s decision to maintain rates while outlining ETF sales has unsettled large-cap stocks and could reshape the equity landscape in the coming quarters. On Wall Street, Nvidia’s multi-billion-dollar investment in Intel has transformed sentiment in the chip sector, reinforcing AI-driven growth narratives across the technology space. At the same time, commodities remain mixed, with gold benefiting from safe-haven demand and oil struggling to gain momentum, as traders weigh the impact of monetary easing and demand risks.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.