Wed, Dec 17

2 min

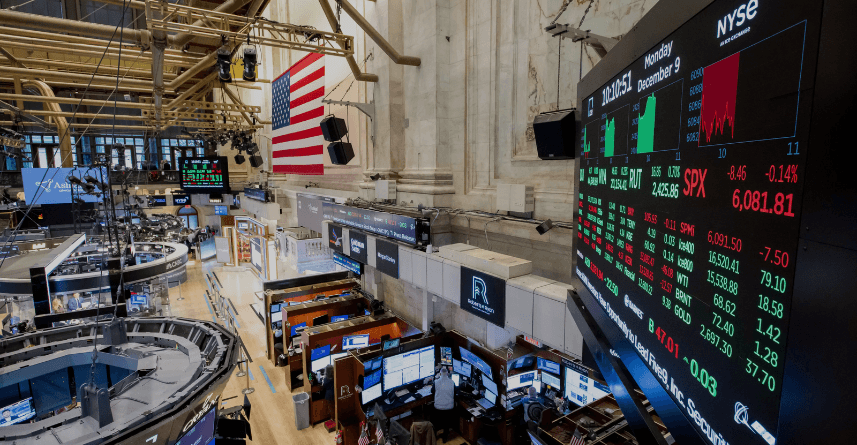

Tech Turbulence and Central Bank Signals Set the Market’s Next Move

Summary

Global markets are navigating a complex landscape shaped by AI-driven innovation, cautious central bank signals, and evolving economic data from Asia. While long-term optimism remains intact, short-term volatility is likely to persist as investors reassess valuations, growth prospects, and policy direction. In this environment, informed decision-making and strategic risk management remain essential for navigating market opportunities.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Global financial markets are moving through a phase of cautious consolidation as investors weigh rapid developments in artificial intelligence, shifting central bank expectations, and mixed economic signals from Asia. While innovation continues to drive long-term optimism, short-term volatility remains elevated as markets assess interest rate paths, growth momentum, and sector-specific risks.

Market Sentiment Remains Fragile but Constructive

Global markets are showing signs of resilience, but confidence remains selective. Equity indices across major regions are trading in tight ranges as investors digest a steady flow of economic data, corporate updates, and policy commentary. While risk appetite has not disappeared, it has become more disciplined, with capital rotating between defensive and growth-oriented assets depending on macro signals. Investors are increasingly focused on sustainability of earnings growth rather than short-term rallies, especially after sharp moves seen in recent months across technology and AI-linked stocks.

AI Sector: Long-Term Opportunity, Short-Term Volatility

Artificial intelligence continues to dominate investment narratives worldwide. While AI remains a powerful long-term growth theme, markets have recently shown signs of fatigue as valuations come under scrutiny. Technology and semiconductor stocks, particularly in Asia, have experienced volatility amid concerns over near-term earnings, capital expenditure cycles, and demand visibility. Despite short-term pullbacks, institutional investors continue to view AI as a structural driver of productivity and innovation. The current market behavior reflects recalibration rather than rejection, as participants reassess pricing and expectations.

Asia Sets the Tone for Global Trading

Asian markets are playing a crucial role in shaping global sentiment. Mixed economic data from China, including softer industrial output and consumption trends, has kept investors cautious. At the same time, Japan remains in focus as speculation builds around future policy normalization and interest rate adjustments. Emerging Asian currencies have also seen pressure as global capital flows respond to U.S. dollar movements and yield differentials. These dynamics often spill over into European and U.S. sessions, reinforcing Asia’s influence on global risk sentiment.

Central Banks Keep Markets on Edge

Central bank expectations remain one of the most significant drivers of market direction. Investors are closely monitoring signals from policymakers regarding inflation control, economic resilience, and the timing of potential rate adjustments. Even subtle changes in tone can trigger sharp reactions across equities, bonds, and currencies. Markets are increasingly data-dependent, with upcoming inflation readings, labor market reports, and growth indicators likely to shape expectations around future policy decisions. Until clarity improves, volatility is expected to remain part of the trading environment.

Commodities Reflect Uncertainty and Hedging Demand

Gold and other precious metals have attracted renewed interest as investors seek hedges against economic uncertainty and policy risk. Energy markets, meanwhile, remain sensitive to geopolitical developments, supply outlooks, and demand forecasts. Commodity price movements continue to serve as a real-time indicator of investor sentiment, often reflecting broader concerns around inflation, growth, and global stability.

Summary

For traders, the current environment emphasizes the importance of flexibility and risk management. Markets are offering opportunities, but selectivity is key. Volatility across asset classes creates both risk and potential, making disciplined strategies, technical confirmation, and macro awareness more important than ever. Periods of consolidation often precede decisive moves, and traders who remain informed and prepared can position themselves effectively when momentum returns.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.