Wed, Sep 17

2 min

AI Buzz, IPO Surges and Commodity Watch

Summary

Ben & Jerry’s co-founder’s exit stirred corporate governance debates, while India’s Urban Company surged over 70% on debut. Chinese tech names like Baidu and Alibaba gained on AI chip momentum, oil prices held firm, and global equities hovered cautiously ahead of Fed remarks.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Global markets are balancing optimism with caution as investors await the Fed’s next move. From India’s booming IPO debut to China’s AI-driven tech rally, and steady commodity markets, the week is shaping up with both excitement and uncertainty.

Ben & Jerry’s Co-Founder Exit Sparks Debate

A report surfaced that Ben & Jerry’s co-founder Ben Greenfield is stepping down, citing “silencing” by parent company Unilever. The move has triggered discussions around brand identity and corporate governance, weighing on Unilever shares, which dipped over 1%. Investors remain cautious as the ice-cream giant navigates both cultural and financial scrutiny.

India’s Urban Company Soars on Debut

In India, Urban Company shares skyrocketed more than 70% in their market debut, signaling strong investor appetite for consumer-focused tech platforms. The stellar listing reflects confidence in India’s growing services economy, even as the broader equity market braces for the U.S. Federal Reserve’s upcoming policy decision.

AI Chips Fuel Chinese Tech Rally

Chinese tech stocks gained momentum as Baidu surged on optimism over in-house AI chip development and a major new partnership. Alibaba also touched near four-year highs, fueled by speculation around Jack Ma and investor enthusiasm for its self-reliance in semiconductors. This rally highlights how AI remains the central growth story across Asia.

Commodities Hold Ground

In commodities, oil prices steadied near two-week highs ahead of the Fed’s rate decision, while gold retreated slightly from recent peaks. The balance between investor caution and central bank expectations continues to dictate flows into safe-haven and energy assets.

Wall Street & Asia Await the Fed

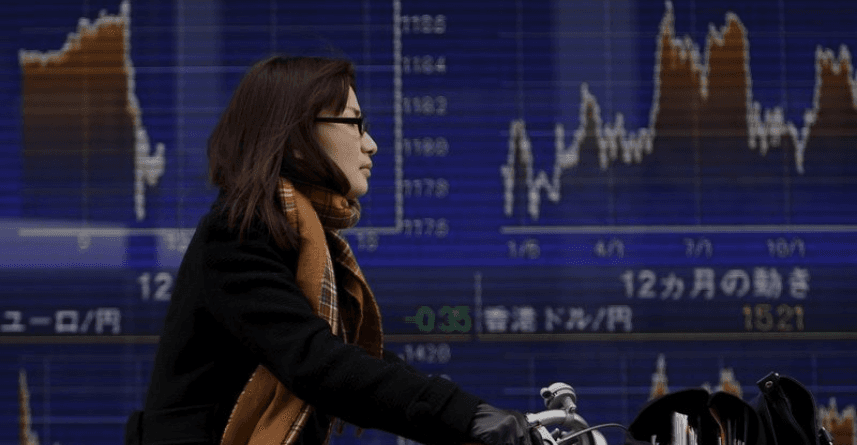

U.S. futures traded cautiously as markets await Jerome Powell’s remarks following the Fed’s meeting. While many investors expect rate cuts later this year, the dollar has remained resilient, keeping Asian FX muted. Regional equities were mixed, Japan hovered near record highs, while China and Hong Kong saw strong support from tech-led optimism.

SGFX Summary

This week reflects a global push-and-pull between innovation and caution. Tech-led rallies in Asia, blockbuster IPOs in India, and commodity resilience highlight the opportunities, but the Fed’s next move remains the key driver for global sentiment. Investors are treading carefully, balancing optimism with the reality of macroeconomic headwinds.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.