Mon, Nov 17

2 min

Markets Mixed: Allianz and Swiss Re Boost Confidence as Tech and Crypto Falter

Summary

Global markets ended the week on a mixed note as strong European financial earnings from Allianz and Swiss Re contrasted with weakness in Asian tech and crypto sectors. Japan’s GDP contracted, China–Japan tensions flared, and fading Fed rate-cut hopes pressured sentiment. Gold stayed resilient near $4,150/oz, oil slipped on easing supply risks, and Bitcoin fell below $94,000. Traders are shifting toward a cautious, diversified stance amid ongoing geopolitical and policy uncertainty.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Global markets traded cautiously on Friday as strong European financial earnings clashed with renewed weakness across Asia’s technology and cryptocurrency sectors. A mix of upbeat corporate performance, slower rate-cut expectations, and geopolitical tensions kept traders on edge ahead of next week’s key policy cues.

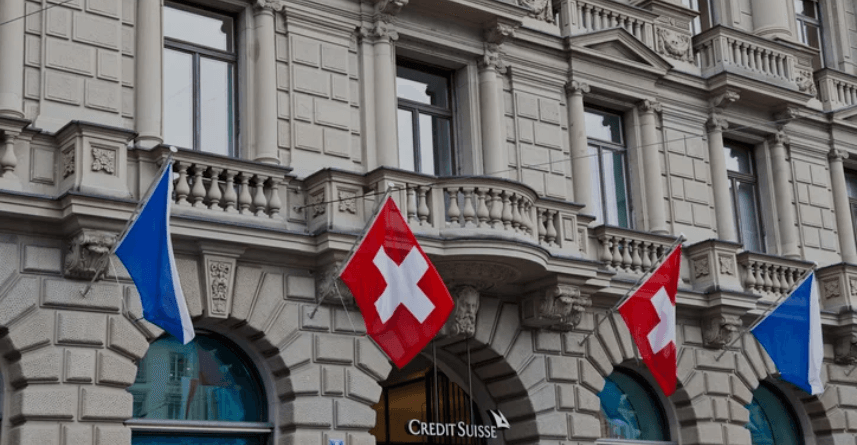

European Giants Lead with Record Earnings

Allianz and Swiss Re delivered upbeat results that lifted sentiment in Europe’s insurance sector. Allianz raised its full-year profit forecast to at least €17 billion following record quarterly results, while Swiss Re reported a $4 billion nine-month profit driven by improved property and casualty performance. These results underline the strength of the European financial system even amid uncertain global growth prospects. Deutsche Bank also remained in focus ahead of its Capital Markets Day, where investors expect updates on restructuring and long-term profitability goals.

Asia: Tech Firms Struggle, Macro Signals Weaken

Asian markets remained subdued after data showed Japan’s GDP shrank 1.8% in Q3, confirming slower momentum in the region’s second-largest economy.

China’s Geely Auto posted a 59% profit jump on strong EV demand, but investor sentiment was capped by weaker factory output and growing diplomatic tension with Japan over Taiwan. Meanwhile, Alibaba expanded its AI footprint with the launch of the Qwen App public beta, signaling China’s continued race to catch up in consumer-AI integration despite market headwinds. Chipmakers Samsung and SK Hynix gained as investors priced in new semiconductor demand, offering a rare bright spot for the region’s equities.

Global Macro: Policy, Politics, and the Dollar

In the macro space, the European Central Bank hinted at possible policy adjustments if digital-asset instability such as a stablecoin run creates financial shocks. Elsewhere, Thailand’s finance ministry reaffirmed its 2%-plus growth outlook for 2025, while China’s stronger rhetoric on Taiwan kept geopolitical risks alive. On currency markets, Asia FX dipped as traders scaled back bets on near-term Fed rate cuts, with the U.S. Dollar Index inching higher.

Commodities and Crypto: Diverging Paths

Commodity markets remained volatile. Oil prices slipped 1% after Russia’s key export port resumed loadings, easing near-term supply risk.

Gold, meanwhile, traded sideways around $4,150/oz, supported by safe-haven demand as traders balanced inflation resilience against slower monetary easing expectations. In contrast, Bitcoin dropped below $94,000, hitting a six-month low as risk appetite faded, while Ethereum and other major tokens followed lower.

Corporate Moves: AI, Energy, and M&A Activity

Corporate headlines continued to shape sector rotations. Peter Thiel reportedly sold his entire Nvidia stake and trimmed Tesla exposure, citing concerns about an “AI bubble.” Elsewhere, Syrah Resources extended its graphite supply deal with Tesla, reinforcing long-term EV material security. Nomura faced internal probes over its India fixed-income division amid allegations of profit inflation, highlighting ongoing compliance scrutiny in Asia’s financial sector.

Summary

Markets are entering a consolidation phase marked by selective strength and rising caution. While Europe’s financial resilience and Asia’s industrial recovery remain encouraging, headwinds from fading Fed optimism and tech-sector rotation are reshaping sentiment. For SGFX traders, this environment underscores the value of multi-asset diversification using gold for stability, oil and indices for momentum, and select equities for tactical growth as global policy and data dynamics evolve.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.