Wed, Dec 3

2 min

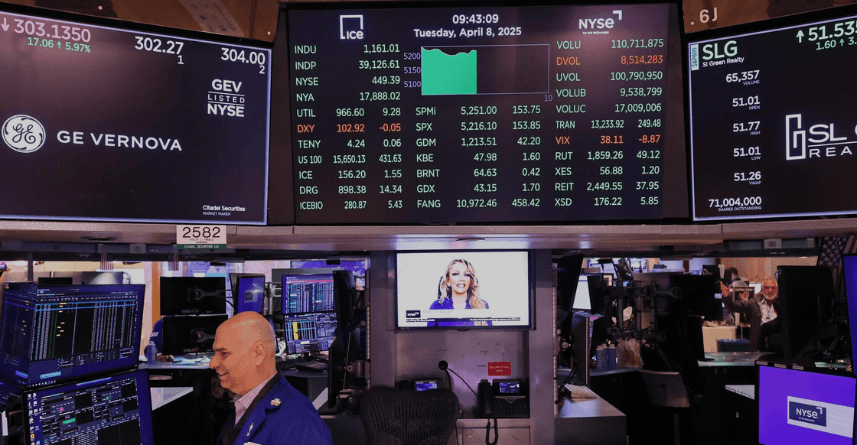

Global Market Roundup: A Day of Split Sentiment Across Regions

Summary

Global markets stayed mixed today as traders balanced rising expectations of U.S. interest rate cuts with cautious sentiment across Asia. Japan and South Korea led regional gains, China lagged on property-sector stress, and oil steadied amid peace-talk signals. Crypto markets surged sharply, while U.S. stock futures held firm ahead of key earnings and economic data.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Financial markets opened the midweek session with a blend of optimism and restraint as investors assessed fresh macroeconomic signals, regional growth indicators, and a renewed surge in digital assets. Strength in Japan and Korea helped offset declines in Chinese equities, while global tech names continued to recover. With expectations of a Fed rate cut building and several crucial reports due this week, traders entered the session positioned for higher volatility across currencies, commodities, equities, and crypto.

Asia Starts Mixed as Japan and Korea Advance While China Slips

Asian markets opened with a divided tone as stronger bets on Federal Reserve rate cuts supported Japan’s Nikkei and South Korea’s KOSPI. Japan’s benchmark index climbed over 1% after Tokyo’s CPI data signaled steady inflation, keeping the Bank of Japan’s tightening path modest. Korean equities also benefitted from tech-sector momentum and growing demand for AI-linked semiconductors.

In contrast, Chinese markets faced renewed selling pressure as worries around property giant Vanke’s debt restructuring deepened. Mainland and Hong Kong indices turned negative, extending a multi-day slide driven by weak credit confidence and fears of liquidity strain across developers.

Australia’s GDP print added another layer of caution, coming in softer than expected as inventory drawdowns weighed on growth.

Oil Prices Stabilize as Ukraine Peace Efforts Shape Sentiment

Crude oil trade remained steady after several sessions of volatility. Ongoing diplomatic discussions surrounding Ukraine supported optimism that geopolitical supply risks may ease in the coming months. While Brent hovered near flat levels, WTI held neutral as traders balanced optimism in diplomatic progress with persistent concerns about global demand.

Energy stocks also reflected this calm, with major producers showing limited movement following the latest API data, which indicated an unexpected draw in crude inventories.

EV and Battery Sector Sees Major Analyst Moves Across Asia

Investor interest in the EV sector remained strong as Piper Sandler highlighted a top China EV stock as its preferred pick for 2026. The sector saw further momentum from Korea after Macquarie reiterated bullishness on selected battery-material names expected to benefit from growing U.S. energy-storage demand.

Despite these upgrades, China’s broader EV market stayed under pressure amid growing concerns about U.S. regulatory scrutiny over potential military-technology ties.

U.S. Futures Stable as Tech Strength Leads and Crypto Rallies

U.S. stock futures traded slightly higher, supported by renewed enthusiasm in tech and AI-related plays. Nvidia, Marvell, and Dell saw extended gains, while Boeing surged double digits after positive corporate developments. The Nasdaq and S&P 500 futures both pointed to a steady open as traders prepared for upcoming jobs data, PMI readings, and key earnings from Salesforce and Snowflake.

Crypto markets stole the spotlight with Bitcoin jumping more than 7% and several altcoins showing double-digit gains. Market analysts attributed the sharp rebound to increased expectations of Fed easing and large-scale institutional accumulation.

IPO and Corporate Highlights Reflect Broad Rebound in Capital Markets

The IPO landscape remained active with SilverBox Corp V pricing a $240 million offering, while Medline prepared for what could become one of the largest healthcare IPOs in recent years. Corporate deal-making continued to accelerate as ServiceNow moved closer to acquiring Veza in a billion-dollar transaction and multiple insiders at tech firms like Surrozen and Grindr made significant share purchases.

Meanwhile, Amazon and TikTok faced fresh regulatory scrutiny in different markets, adding to global tech-sector uncertainty even as investor interest remained solid.

Commodities and FX Turn Cautious Ahead of Data Releases

The FX market held a muted tone with the dollar index steady and major Asian currencies showing modest movement. The Japanese yen weakened slightly following CPI data, while the Korean won strengthened further on supportive central bank policy guidance.

Gold prices remained range-bound after Tuesday’s surge, with traders locking in profits as U.S. yields edged higher again. Silver and platinum traded similarly, reflecting a cautious stance ahead of the next Fed announcement.

Summary

Market conditions are shifting quickly as global central banks inch closer to potential rate cuts, and regional economies reveal mixed recovery patterns. With major earnings, U.S. labor data, and fresh geopolitical developments on the horizon, volatility will likely increase across forex, commodities, and indices. Traders using SGFX should remain alert to opportunities in yen pairs, gold pullbacks, and tech-driven equity indices, while monitoring crypto’s sharp intraday swings for potential momentum setups.

More Articles:

Markets Recalibrate: Allianz Boosts Outlook, Gold Holds Firm and Tech Faces a Pullback

Analyzing the Financial Implications of the State of Climate Action Report

Analyzing the Impact of EFCC's N100 Billion Investment in Nigeria's Student Loan and Credit Schemes

Strategic Expansion: IHCL's $1.76 Million Investment in OIHK

Stay Ahead of the Market

Subscribe for the Latest Trading News

Get expert insights, market news, and updates straight to your inbox.